Some people seem to have a gift for managing money. They make good use of whatever funds they have, be they great or small. Other people are forever being pushed around or rendered unhappy by money problems of one sort or another. Is there any basic difference between the two types? I think there is. One regards money as a medium of exchange – nothing more. The other lets money become a symbol of something else. Smiley Blanton “The Hidden Face Of Money “

From the moment we enter the world we are observing beings. As children we observe the things and people around us, and based on those observations develop conclusions or imprints to live by. An imprint is a significant event from the past in which a belief or a cluster of beliefs is formed that shape our world view.

What comes to mind for me is as a child, a couple who were good friends of my parents was hit by a train. My child’s mind could not understand how someone could not be aware of an oncoming train and I concluded that the train must come out of nowhere, like in a cartoon, and the only way to avoid this hidden danger was to avoid trains. I developed a deadly fear of being anywhere near a train because you never knew when that cartoon like train would strike. As I grew older that fear stayed with me and I had no need to correct the impression. It was not until I was in college and in a car with a group of students rushing back to campus for a very important exam, and the driver decided to outrun a train that I realized the truth. It was in that frightening moment it came to me that the train did not come out of nowhere like in the cartoons. Those friends of my parents were trying to outrun the train and did not make it! I was surprised how a memory so simple had stayed with me. That moment changed my outlook regarding trains and my new script was to respect the power that trains possessed but no longer to be afraid of them.

In that same manner, our money personalities become out of balance when they are built upon a series of conclusions much like mine about trains that are not true for our life situation.

Make no mistake these conclusions or interpretations are quite powerful in that they affect every area of our decision making. They range from the youngster whose alcoholic father’s drinking ravaged the family’s finances and never had what the other kids had who as an adult now feels he needs the top of the line in everything when he can’t afford it; to the woman raised in a very controlling household who now can’t seem to stop buying things.

We see these people all the time on so called “reality” TV shows. They buy and buy and yet cannot see the obvious flaws in this approach despite the advice of the on site money coach. These situations are accidents waiting to happen and yet despite their best intentions these serial spenders somehow still manage to sabotage their efforts. The natural inclination is to think that education will cause them to change their behavior but somehow most never do. They keep repeating the same pattern for the simple reason that their spending habits are not about money, These people are playing out a script they are unaware of as they follow an imprinted past interpretation.

These interpretations govern not only how we see ourselves but also how we wish others to see us and are generally our unconscious fall back behaviors as we confront various life and money situations. They are deeply personal interpretations of life events that combine to develop the belief system against which we act out our money lives.

Change your belief system, change your life!

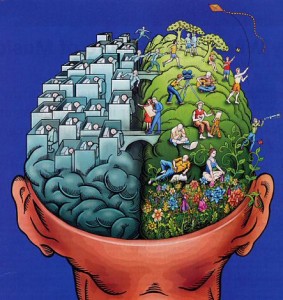

It is possible to change. But, the hardest part of changing any belief system is the fact that the imprint supporting a belief is probably out of conscious awareness. By bringing into consciousness our dominate style we become able to work on re-imprinting and working into balance the parts of the original imprint that work against us and strengthening those parts that work for us. Think of the concept as much like an iceberg with a small portion (the spending behavior) in full view for all to see. But, below the surface is an even larger portion that is a complex system made up of vows and promises, made over a lifetime that have been stored away from view. The combination of the two is what we will call an archetype because we see similar behavior in a broad spectrum of people.

An archetype is a model of a person, personality, or behavior that can be related to a large segment of the population. Our money personality revolves around six archetypes that encompass a spectrum that moves from excessive spending behavior to actual hoarding.

An archetype overview:

1. Mr. Bling: Is generally a person who has a lot of flair and a great sense of style. The driving force behind this personality is the prestige or recognition from others as it relates to his purchases, even if he cannot afford it. “Top of the line.” Is a frequent refrain.

2. Ms. Thing: Is less concerned with prestige and more with the thrill of the chase for acquiring things. They enjoy the stimulation they receive from the experience of shopping. They can range from the constant bargain shopper to the shopaholic.

3. Mr. Optimism: These people are the friends who are always talking to you about the latest get rich quick scheme they are now pushing. Other areas of their lives may be quite ordered but they are always dropping large sums of money in overly optimistic schemes that never seem to pan out. You can always count on them for the latest stock market tip.

4. Miss Aversion: Is the over organized overscheduled mover and shaker who just does not have the time to sit down and go over boring things like their finances. These people are overwhelmed by all the activities in their lives. They can plan a huge event but cannot tell you how much money they have in their checking account.

5. The Virgin: “I just don’t understand money and need someone to handle it for me” is a frequent refrain for this group. They frequently may allow others to take advantage of them to the point that they are deeply in debt.

6. The Monk: Are the moralists of the world. They are afraid of money and tend to live like monks. For them money is a corrupter and self denial is almost punishment.

7. Mr. Dread: Is a variation of the Monk but is afraid “something” will happen and he will lose all his money. They fall into the generalized anxiety disorder category as it relates to money and spend a great deal of time keeping track of every penny.

8. Mr. Accumulator: No amount of money is ever enough best describes them. A great many are workaholics dedicated to the accumulation of every more. For them money is a score card and they want to win BIG.

Each archetype has its own strengths and weaknesses in the bundle of beliefs that makes the “you”, you. And, the aim is help find out where a trait of the imprint is in conflict or out of balance with conscious goals. Basically, we want to rebalance a trait or imprint because there is something charmingly useful in each type that makes up our total personality. If we try to completely erase an imprint, then we create a greater imbalance even more in conflict with our established personality. I say that because no matter how dysfunctional a behavior is, for each person it serves some useful purpose, known only to their unconscious. It helps to understand this concept if we keep in mind this trait has been with them for years and in a strange manner is almost regarded as a “friend.” In a test of wills, the “friend” will win!

In the process of devising a new script to re-imprint we want to understand the current belief system traits, to bring them to light, encourage the modeling of traits from other archetypes, and help understand how this modeling is useful to them. In other words help the person negotiate with themselves to establish a new normal.